NoCode is not a new concept. The premise of nonprogrammers developing and maintaining applications has been around for a long time under names like Visual Programming or Rapid Application Development. Although it’s a novel concept, the technology never took hold or rose to popularity in its early forms. However, over the past few years, a surge of new technology platforms – oriented around building web interfaces – has triggered a cascade in the popularity of the idea, now rendered under the name NoCode or No-Code.

Building a Database of NoCode Tools

As the founder of an early NoCode platform, I decided to quantify the rise of NoCode by collecting and analyzing some sets of data oriented around NoCode’s popularity. I began by building a database of the available NoCode tools on the market. The initial data was sourced from 4 different websites:

- Capterra’s Application Development Software Category with No-Code feature (164 products).

- G2’s No-Code Development Platforms Software Category (93 products).

- NuCode’s tools list (62 products).

- Makerpad’s marketplace (30 products).

After cleaning up the duplicates and removing the products that no longer exist, I was left with 416 distinct tools. I intend to update this database regularly, since new tools are entering this market constantly.

Since NoCode is such a broad concept and there are hundreds of related tools, I wanted to keep it limited to its core definition: a development platforms where users can build a complete application with user interface, business logic, and data collection. For example, I included website development platforms like Webflow, WordPress, and Wix, because they also support incorporating application-specific features through built-in or third-party extensions. WordPress has an especially impressive library of third-party extensions.

I also included form-building platforms because they incorporate drag-and-drop interfaces to build web application that can also include data collection and some level of logic and workflow building.

I reluctantly included Business Process Modeling (BPM) platforms. Although they do often include drag-and-drop interfaces, they are more geared towards workflow automation over application development.

I also excluded a bunch of categories that some may consider as NoCode. First, I excluded LowCode platforms unless they have the ability to create a complete application without coding. As a result, a good portion of BPM platforms were excluded, since they are primarily LowCode platforms.

I excluded any ancillary products such as Zapier, Figma, IFTTT, PayPal, Memberstack, Slack, Trello, Twilio, and Integromat. These products are often used by other NoCode platforms but they are not NoCode development platforms in-and-of themselves.

Category-specific platforms like data visualization, HR automation, and sales automation have also been excluded. You can build an application for specific purposes on those platforms, but you cannot go beyond that specific usage. I also excluded NoCode game development platforms for the same reason.

Finally, I excluded mobile-only platforms for the time being, since those products tend to build limited-feature applications compared to multi-platform NoCode products, which are tailored towards building more complex applications.

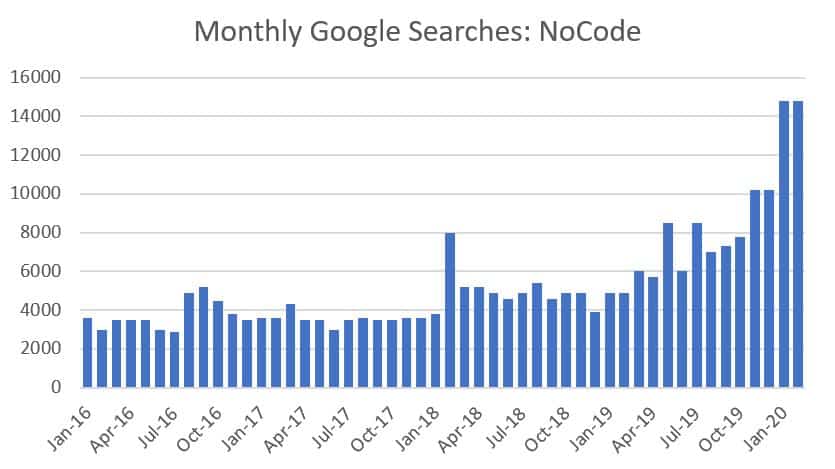

Google Searches of NoCode

Google searches are an important indicator of the popularity of NoCode. Google AdWords has monthly search data beginning in January 2016. I included keywords of “NoCode” and “No Code” in this analysis. The chart below indicates an increase in popularity of over 200% since January 2019.

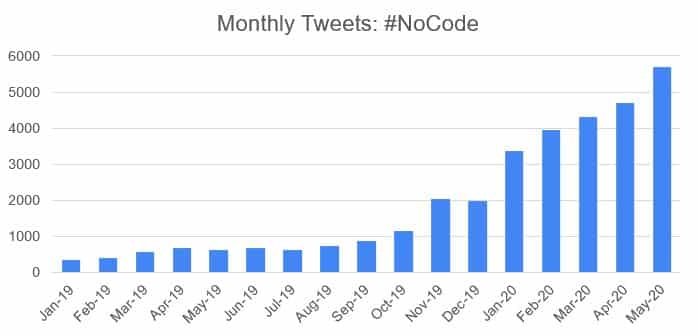

Number of Twitter Posts with #NoCode

Twitter hashtags is another good indicator of the popularity of NoCode. I extracted all tweets with hashtag #NoCode from January 2019. The chart below shows those monthly tweet counts since January 2019. You can see that the number of tweets went up about ten-fold over that time frame.

Chart updated on June 1, 2020

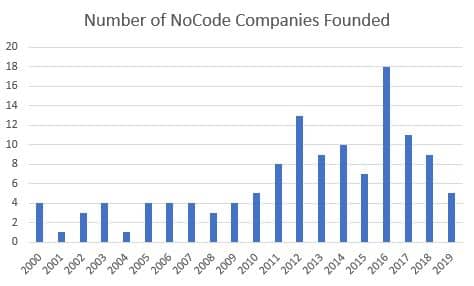

Number of NoCode Startups Formed

The number of companies developing new NoCode platforms is another indicator of its popularity. This tends to be a leading indicator, as most startups take a few years from their founding before they release a product. They focus this time on business-oriented objectives, like raising capital, building their team, and developing the technology.

The chart indicates a trend, although not an obvious one, starting around 2011-2012 where a surge of NoCode startups were being formed.

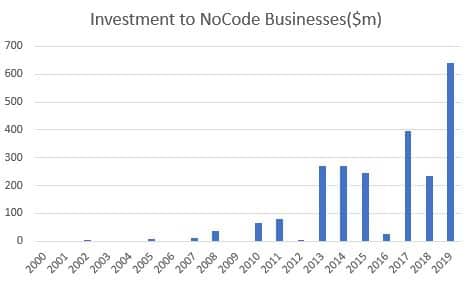

Investments in NoCode Companies

This is another indicator of interest in NoCode’s popularity, although this one stems from the investor community. I only included single product companies to be able to measure investments into NoCode accurately. For example, companies like Microsoft (PowerApps) and Zoho (Creator) were excluded from this list. Also excluded were investments for companies that were already acquired, like QuickBase, which is one of the earliest NoCode platforms. Note that I did include AppSheet since it was acquired just one month ago. All investment data is coming from CrunchBase.

I also excluded public companies from the list. For example, Survey Monkey had raised over $1.1b before going public in 2018, but that is not included since it’s an outlier and would skew the data significantly based on a single company.

Companies receiving multiple rounds of investment have been represented by annual investment amounts to reflect the continuing interest in the segment from the investment community on a year over year basis.

The chart indicates a clear trend in NoCode companies’ increased potential to raise capital. It is also consistent with the chart of NoCode startups, since most of these companies start with seed capital. It takes them some time to reach the potential to raise larger venture rounds, which represent the growing numbers in the chart.

Mergers & Acquisitions of NoCode Companies

As the numbers above show, the rise of NoCode platforms is a relatively recent phenomenon. Since it is still early, there is no reason to expect a significant influx of mergers and acquisitions in this segment yet.

Thus far, there have been two major platform acquisitions. In January 2019, Vista Equity Partners acquired a majority stake in QuickBase, bringing the value of the company to $1 billion. Prior to that, Welsh Carson Anderson & Stowe acquired QuickBase from Intuit in 2016. Welsh Carson Anderson & Stowe still maintains a minority stake in the company.

The second acquisition occurred in January 2020 when Google acquired AppSheet. Financial details of this acquisition have not been disclosed, but we know that AppSheet had previously raised more than $17m, which brought the company’s value to around $60m at the time.

NoCode is Only Going to Get Bigger

The idea of empowering nonprogrammers to build and maintain applications without relying on scarce IT resources presents a tremendous value for businesses of all sizes. Market research firms have already started predicting tremendous growth in this segment over the next few years.

The data in this article shows that the rise of NoCode platforms is real, and – if the trajectories hold steady – the market will only get bigger. The extent of this rise will depend largely on businesses’ willingness to transform the way that they develop software, as well as the level to which the available NoCode platforms can successfully meet the requirements of those businesses. While NoCode platforms will never replace traditional programming, even substituting for a portion of business application development and maintenance can translate into a huge market opportunity.